📉 Market Outlook Amid Escalating Middle East Conflict (June 2025)

Monday, 16 June 2025

Following Israel’s recent strikes on Iranian nuclear facilities and Iran’s missile retaliation, global markets saw a brief spike in volatility. Oil prices jumped 13% but quickly stabilized. Despite fears of a broader war, historical patterns suggest that regional conflicts, while tragic, rarely derail global markets for long.

Iran accounts for just 4% of global oil output, and even disruption in the Strait of Hormuz seems unlikely to cause lasting damage due to high global inventories and flexible supply chains. Israeli markets, most directly exposed, were the top performers in 2024, signaling limited long-term risk perception.

While uncertainty may drive short-term moves, markets typically rebound quickly during bull runs – even amid war. Investors are urged to stay focused on fundamentals rather than reacting to geopolitical headlines.

May 2025 Performance update

Monday, 2 June 2025

📈 +11.02% Profit!

We’re excited to share the results from May – and it was another strong month for our clients!

Thanks to consistent strategy execution and optimal market conditions, MaxAi Trader customers achieved a net profit of +11.02% this month.

This performance continues our commitment to delivering reliable, data-driven trading results. Whether you’re compounding or withdrawing profits regularly, this result reflects the strength and stability of our system.

April 2025 Performance update

Thursday, 1 May 2025

MaxAiTrader Outperforms Amid Historic Market Turbulence

April 2025 delivered one of the most volatile months in recent memory. Global markets were rocked by newly imposed international tariffs, culminating in the largest single-day drop since Black Monday in 1987. Major indices across the world plunged, and investor sentiment hit extreme lows.

Despite the chaos, MaxAiTrader stayed resilient — delivering a solid return of 8.78% profit for the month. While the world index posted negative returns, our AI-powered trading system not only preserved capital but also outperformed traditional benchmarks by a significant margin.

This performance highlights MaxAiTrader’s ability to adapt to fast-changing market conditions and seek out profitable opportunities where others retreat. In times of uncertainty, algorithmic precision and disciplined risk management make all the difference.

March 2025 performance update

Monday, 31 March 2025

MaxAi Trader Delivers 9.01% Profit Amid Market Uncertainty

Despite heightened market volatility triggered by renewed concerns over Trump’s proposed tariffs and a sharp decline in the Dow Jones, MaxAi Trader has once again demonstrated resilience and precision. Our AI-driven strategies delivered an impressive 9.01% profit to our customers, proving that data-driven trading can outperform even in turbulent conditions.

While many investors struggled to navigate the unpredictable swings, MaxAi Trader’s advanced algorithms adapted swiftly, capitalizing on key opportunities across various asset classes. This performance reaffirms our commitment to providing consistent and profitable trading signals, regardless of market sentiment.

Check out the clip to see the power of MaxAiTrader’s dynamic lot sizing in action! ⚡

New version 2.2 available for MaxAi Trader software

Friday, 14 February 2025

Exciting Update: Dynamic Lot Size Now Available in MaxAiTrader!

We are always striving for improvements, and we’re thrilled to introduce the Dynamic Lot Size option in MaxAiTrader! This new feature enhances risk management by automatically adjusting lot sizes based on your equity, optimizing your trading performance.

In this backtest, we ran MaxAiTrader over 2 years, starting with an initial deposit of $1000 — and the results speak for themselves! 📈 The strategy successfully generated an impressive $5838 profit while maintaining steady risk control.

February 2025 performance update

Friday, 28 February 2025

MaxAiTrader Delivers a Strong 6.88% Profit in February 2025

As we step into 2025, financial markets continue to navigate a complex landscape of economic shifts, AI-driven trading, and investor sentiment. In the midst of it all, MaxAiTrader has emerged as a standout performer, delivering an impressive 6.88% profit in February. This performance underscores the power of AI-driven trading strategies and precision-driven market insights.

Tiny Bubbles: The Hidden Risks in Today’s Market

Monday, 24 February 2025

Markets have kicked off 2025 on a strong note, and while optimism is high, no bull market is without risks. The usual concerns—tariffs, debt, and sluggish European growth—dominate headlines, but the real threats often lurk beneath the surface. One such risk? The overlooked “tiny bubbles” forming in key market sectors, including private equity (PE). While not large enough to collapse the market alone, these bubbles could trigger broader disruptions if they burst simultaneously.

The Rise of Private Equity and Its Hidden Vulnerabilities

Originally, private equity was about turning around struggling companies—acquiring them, fixing their financials, and then taking them public again for profit. Over time, this model evolved, especially after the Sarbanes-Oxley Act of 2002, which made public company compliance more complex and costly. As a result, firms began staying private longer, leading to the rise of unicorns—startups valued at over $1 billion that, in a previous era, would have gone public much earlier.

Today, PE firms are heavily involved in these unicorns, offering alternative exit strategies for early investors. However, this shift has introduced new risks. Unlike public markets, where stocks are traded daily, private company valuations are far less transparent. Investors often assume private assets are insulated from downturns, but that is a dangerous misconception. Valuations do get cut, and many PE firms are currently writing down struggling holdings.

What Happens if a Recession Hits?

Private equity operates on cycles, and when downturns come, firms often call on investors for more capital to sustain their holdings. This practice, known as capital calls, forces investors to either inject more cash or liquidate other assets—potentially leading to stock sell-offs and reinforcing a negative market cycle.

Recently, the PE industry has pushed to expand investor access, introducing private equity ETFs and lobbying for inclusion in retirement accounts. While this increases liquidity in the short term, it also exposes a broader group of investors to risks they may not fully understand. The question is: what happens when liquidity dries up?

Why This Matters for Investors

While private equity’s total exposure—estimated at around £1.0 trillion in extreme scenarios—is not large enough to crash global markets, the real risk lies in multiple tiny bubbles bursting at once. If PE struggles coincide with other market disruptions, we could see a ripple effect similar to the hedge fund selloff of late 2018, where panic selling accelerated price declines.

Fortunately, we are not seeing systemic cracks—yet. But investors should remain vigilant, watching for signs of distress in private markets. At MaxAI Trader, we monitor these hidden risks, helping traders and investors stay ahead of potential market shifts.

Bottom Line: Don’t Ignore the Tiny Bubbles

As Don Ho’s 1967 song goes, “Tiny Bubbles” may seem harmless—until they burst. While no single bubble is an immediate market threat, a combination of liquidity crunches, capital calls, and investor panic could create an unexpected market shake-up. Stay informed, stay cautious, and always be prepared.

For more insights on market risks and opportunities, stay connected with MaxAi Trader.

January 2025 performance update

Friday, 31 January 2025

MaxAiTrader Delivers a Strong 5.25% Profit in January 2025

As we step into 2025, financial markets continue to navigate a complex landscape of economic shifts, AI-driven trading, and investor sentiment. In the midst of it all, MaxAiTrader has emerged as a standout performer, delivering an impressive 5.25% profit in January. This performance underscores the power of AI-driven trading strategies and precision-driven market insights.

New version 2.1 available for MaxAi Trader software

Friday, 10 January 2025

New Feature: Auto-Close 3rd Open Trades Before Next Session!

In December 2024, we noticed something unusual—four buy trades didn’t hit their take profit targets. This was highly unexpected, as it hadn’t happened in the past four years of backtesting. To address this, we rolled out an update to ensure that no more than two consecutive trades can be open at once. After thorough backtesting, the update performed flawlessly, making MaxAiTrader even more robust and prepared for rare scenarios like this.

January 2025 global market update

Wednesday, 22 January 2025

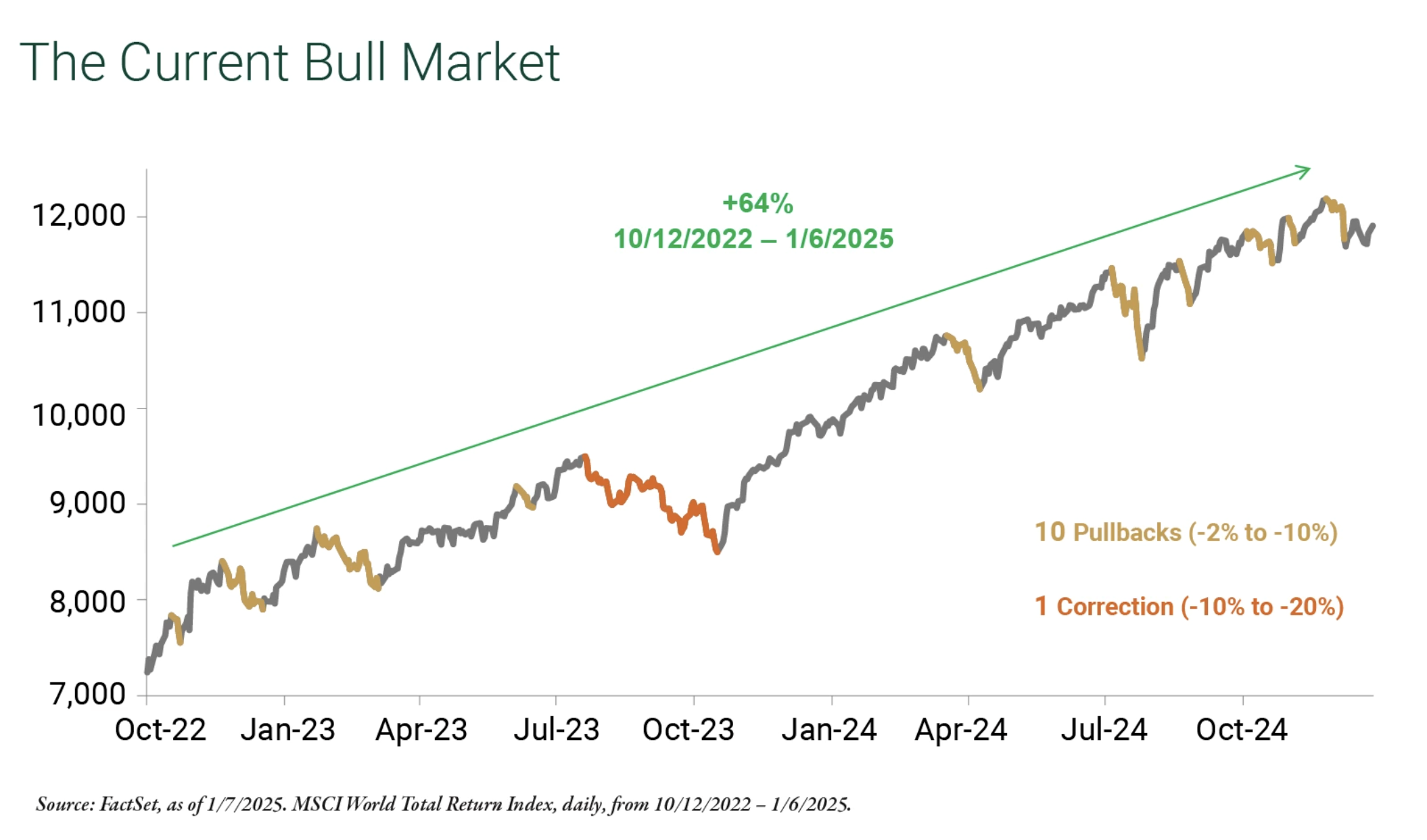

Since October 2022, the market has demonstrated remarkable resilience, climbing steadily by an impressive +64%, as shown by the upward green trend line. Despite facing 10 pullbacks (ranging from -2% to -10%) and one more significant correction (-10% to -20%), the market has maintained its strong bullish momentum.

This sustained growth reflects the robustness of the current bull market, which has weathered challenges and continued its upward trajectory, underscoring investor confidence and the market’s ability to adapt and recover from short-term declines.

Bull Market Third Years

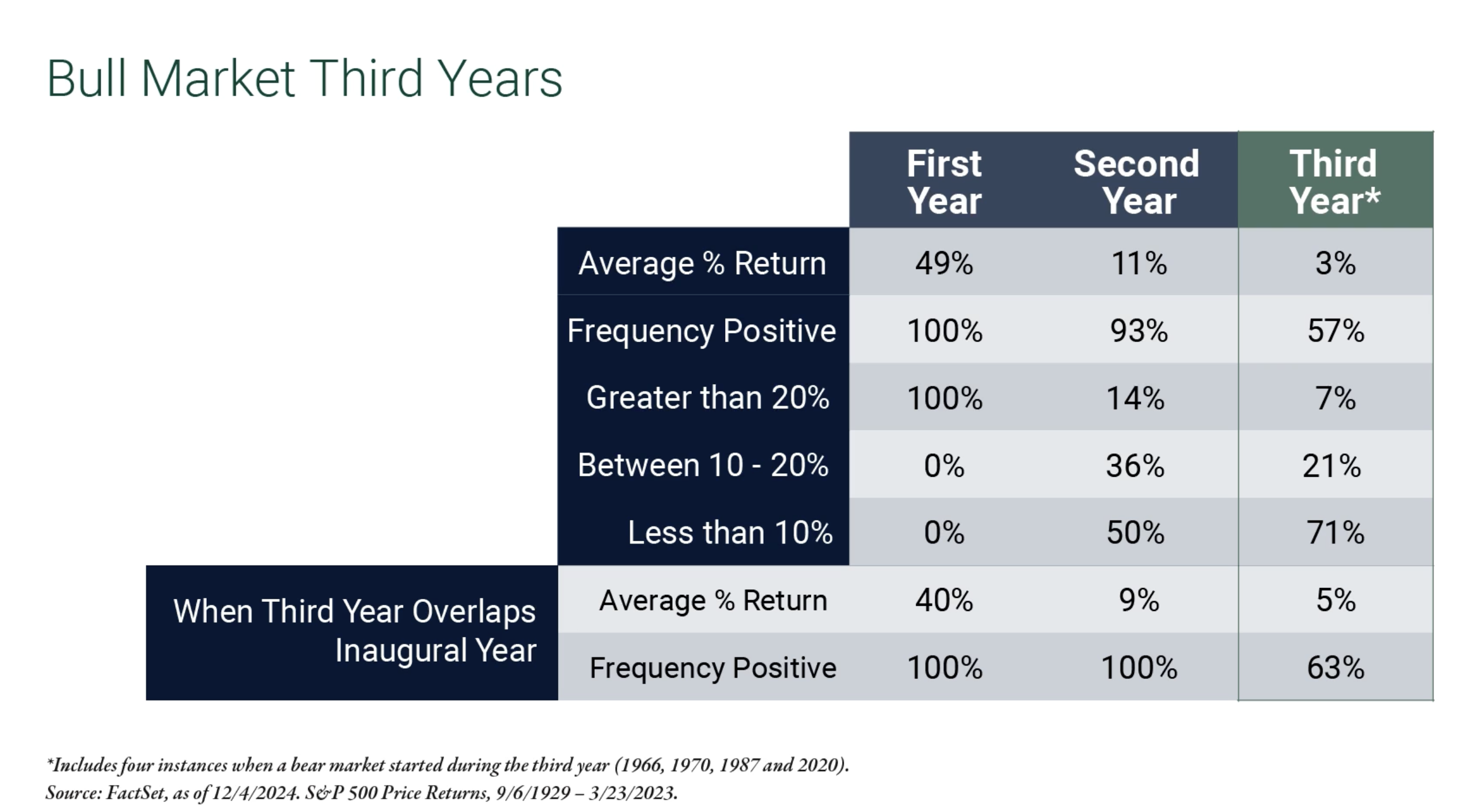

This table provides insights into the historical performance of bull markets over their first, second, and third years, with particular focus on average returns and the frequency of positive outcomes.

Key Observations

First Year:

• The average return is an impressive 49%, with a 100% frequency of positive performance.

• In this phase, 100% of returns exceed 20%, showcasing the strength and momentum typical of the early stages of a bull market.

Second Year:

• The average return drops to 11%, with a 93% frequency of positive outcomes.

• Only 14% of returns exceed 20%, while 36% fall between 10–20%, and 50% are under 10%.

• This indicates a slowing of growth compared to the first year but still predominantly positive outcomes.

Third Year:

• The average return further decreases to 3%, and the frequency of positive outcomes declines to 57%.

• Only 7% of returns exceed 20%, while 21% fall between 10–20%, and the majority (71%) are below 10%.

• This shows that the third year often represents a plateau or cooling-off period in bull markets.

Third-Year Overlaps with Inaugural Years:

• When a bull market’s third year overlaps with an inaugural year of a new market phase (e.g., after a bear market), the average return is 40%, with 100% frequency of positive outcomes.

• This overlap represents rare instances where the third year benefits from renewed market strength.

Summary

The data highlights that bull market performance typically diminishes over time, with the first year being the most explosive. By the third year, returns are significantly lower, with positive outcomes less likely. However, unique cases where the third year coincides with a new market phase can still deliver substantial gains.